When it comes to managing finances as a freelancer or small business owner, choosing the right bank account is crucial. In this guide, we will delve into the world of business bank accounts, comparing options tailored for freelancers and SMEs.

From different types of accounts to banking fees, online services, interest rates, and rewards, we'll help you navigate the complexities of business banking to make an informed decision.

Types of Business Bank Accounts

When it comes to choosing a business bank account, freelancers and SMEs have several options to consider based on their financial needs and preferences. Let's explore the different types of business bank accounts available and compare the features and benefits of basic business checking accounts versus premium accounts.

Basic Business Checking Accounts

Basic business checking accounts are designed for freelancers and small businesses looking for a simple and cost-effective banking solution. These accounts typically offer essential features such as online banking, mobile banking, check writing capabilities, and access to ATMs. They may have low or no monthly maintenance fees, making them an attractive option for those just starting.

- Low or no monthly maintenance fees

- Online and mobile banking options

- Check writing capabilities

- Access to ATMs

Basic business checking accounts are ideal for freelancers and SMEs looking to manage day-to-day transactions without incurring high fees.

Premium Business Accounts

Premium business accounts are tailored for businesses with higher transaction volumes and more complex financial needs. These accounts often come with additional perks such as higher transaction limits, cash management services, merchant services, and dedicated relationship managers. While premium accounts may have higher monthly fees, they offer more comprehensive banking solutions.

- Higher transaction limits

- Cash management services

- Merchant services

- Dedicated relationship managers

Premium business accounts are suitable for established SMEs that require more advanced banking services and personalized support.

Eligibility Criteria for Opening a Business Bank Account

To open a business bank account as a freelancer or SME, you will typically need to provide certain documents and meet specific eligibility criteria set by the bank. This may include proof of business registration, identification documents for the account holders, business financial statements, and credit history checks.

Each bank may have its own requirements, so it's essential to check with the institution beforehand.

- Proof of business registration

- Identification documents for account holders

- Business financial statements

- Credit history checks

Meeting the eligibility criteria is crucial for freelancers and SMEs looking to open a business bank account to ensure a smooth application process.

Banking Fees and Charges

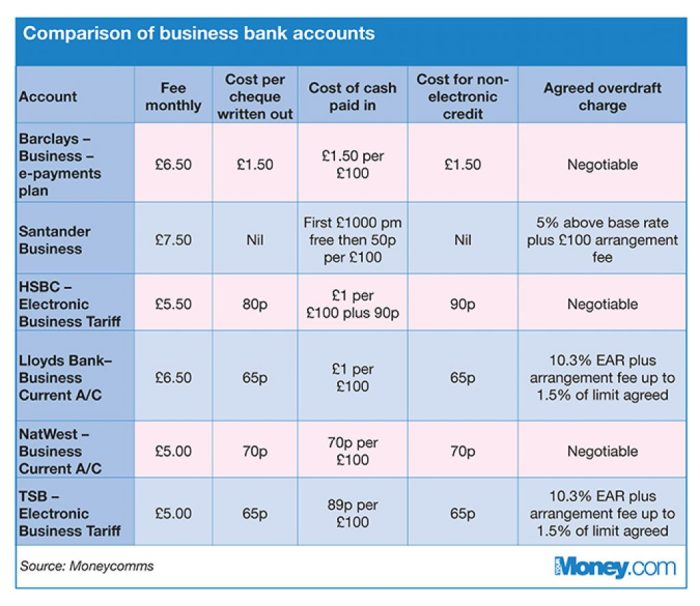

When it comes to business bank accounts, understanding the various fees and charges involved is crucial for freelancers and SMEs to manage their finances effectively. Let's dive into the common fees associated with business bank accounts and how you can minimize them.

Monthly Maintenance Fees

Monthly maintenance fees are a fixed amount that banks charge to keep your business account open. These fees can vary depending on the bank and the type of account you have. Some banks may waive the monthly fee if you maintain a minimum balance or meet certain criteria.

It's essential to compare different banks and account options to find one with reasonable or no monthly maintenance fees.

Transaction Fees

Transaction fees are charges incurred every time you make a transaction, such as deposits, withdrawals, or transfers. These fees can add up quickly, especially for businesses with high transaction volumes. Look for banks that offer a certain number of free transactions per month or lower transaction fees to save on costs.

Overdraft Fees

Overdraft fees are charged when you spend more money than you have in your account, leading to a negative balance. These fees can be hefty and impact your business finances significantly. To avoid overdraft fees, monitor your account balance regularly, set up alerts for low balances, and consider opting out of overdraft protection if it's not necessary for your business.

Comparing Fee Structures

When choosing a business bank account, compare the fee structures of different banks to find one that aligns with your financial needs. Consider factors such as monthly maintenance fees, transaction fees, overdraft fees, and any other charges that may apply.

Look for accounts that offer fee waivers, discounts, or lower fees based on your business activities and requirements.

Tips to Minimize Banking Fees

- Maintain a minimum balance to avoid monthly maintenance fees.

- Opt for electronic transactions over in-branch transactions to save on transaction fees.

- Monitor your account closely to avoid overdraft fees and set up alerts for balance notifications.

- Negotiate with your bank for fee waivers or discounts based on your business relationship and transaction volume.

- Regularly review your account activity and assess if there are any unnecessary fees that can be eliminated.

Online Banking Services

Online banking services play a crucial role in the day-to-day operations of freelancers and SMEs, offering convenience, efficiency, and security in managing financial transactions.

Comparison of Online Banking Features

- Mobile Banking Apps: Many banks provide mobile apps that allow freelancers and SMEs to access their accounts, make payments, and monitor transactions on the go.

- Bill Pay: Online banking platforms offer the convenience of paying bills electronically, saving time and reducing the risk of missing deadlines.

- Fund Transfers: Easy fund transfer options enable freelancers and SMEs to send money to clients, suppliers, or employees seamlessly.

Security Measures for Online Transactions

- Encryption: Banks use encryption technology to secure online transactions, protecting sensitive information from unauthorized access.

- Multi-factor Authentication: Additional layers of security, such as one-time passwords or biometric verification, help verify the identity of users during online banking activities.

- 24/7 Monitoring: Banks continuously monitor online transactions for any suspicious activity, providing an added layer of protection for freelancers and SMEs.

Interest Rates and Rewards

When it comes to business bank accounts for freelancers and SMEs, understanding the interest rates and rewards offered is crucial for maximizing financial benefits.

Interest Rates on Business Savings Accounts

- Business savings accounts typically offer higher interest rates compared to regular savings accounts, allowing freelancers and SMEs to earn more on their idle funds.

- Some banks may offer promotional interest rates for a certain period to attract new business customers, so it's important to compare these rates before opening an account.

- Freelancers and SMEs should consider the frequency of interest compounding and any minimum balance requirements to ensure they are getting the best return on their savings.

Rewards Programs for Business Credit Cards

- Many business bank accounts come with the option to link a business credit card, which often includes rewards programs such as cash back, travel rewards, or discounts on business expenses.

- Freelancers and SMEs can leverage these rewards programs to earn valuable perks on their everyday business spending, helping to offset costs and improve cash flow.

- It's important to compare the rewards offered by different business credit cards, considering factors like annual fees, redemption options, and bonus categories to find the best fit for your business needs.

Leveraging Interest Rates and Rewards

- By strategically managing their business finances, freelancers and SMEs can take advantage of higher interest rates on savings accounts to grow their funds over time.

- Utilizing rewards programs on business credit cards can help businesses save money on expenses and earn valuable incentives that contribute to overall financial success.

- Regularly reviewing interest rates, rewards programs, and banking fees can ensure freelancers and SMEs are optimizing their banking benefits and making the most of their financial resources.

Final Summary

As we wrap up our discussion on Comparing Business Bank Accounts for Freelancers & SMEs, it's clear that the right choice can significantly impact your financial operations. By understanding the nuances of various account types, fees, and services, freelancers and SMEs can optimize their banking experience and maximize benefits.

Remember, a well-informed decision today can pave the way for financial success tomorrow.

Common Queries

What are the eligibility criteria for opening a business bank account?

Eligibility criteria typically include proof of business registration, identification documents, and sometimes a minimum deposit amount. Requirements may vary between banks.

How can freelancers and SMEs minimize banking fees?

To minimize fees, consider choosing accounts with lower maintenance and transaction fees, maintaining minimum balances, and opting for online banking to reduce paperwork costs.

What security measures protect online transactions for freelancers and SMEs?

Online banking services often employ encryption technologies, secure login procedures, and transaction monitoring to safeguard against unauthorized access and fraud.