Exploring the realm of Unsecured Business Lines of Credit for New Businesses, this introduction aims to shed light on the significance and benefits of this financial tool for budding enterprises.

Delving deeper into the qualifications, pros and cons, and application process, this comprehensive guide navigates the complexities of unsecured credit with clarity and insight.

Introduction to Unsecured Business Lines of Credit for New Businesses

Unsecured business lines of credit are financial tools that allow new businesses to access funds without the need for collateral. These credit lines provide flexibility and quick access to capital for various business needs.

Importance of Unsecured Credit for New Businesses

Unsecured credit is crucial for new businesses as it helps them establish a financial track record and build credit history. This can be beneficial in securing larger loans or financing in the future. Additionally, unsecured credit provides the necessary funds for operational expenses, inventory purchases, or unexpected costs without risking valuable assets.

Examples of How Unsecured Credit Can Benefit New Businesses

- 1. Cash Flow Management: Unsecured credit lines can help new businesses manage their cash flow effectively by providing access to funds when needed, especially during slow seasons or unexpected expenses.

- 2. Business Growth: With unsecured credit, new businesses can seize growth opportunities by investing in marketing, hiring additional staff, expanding product lines, or upgrading equipment.

- 3. Emergency Funds: Having an unsecured credit line in place can act as a safety net for new businesses during emergencies or unforeseen circumstances, ensuring continuity of operations.

Qualifications and Requirements

When it comes to securing an unsecured business line of credit for a new business, there are certain qualifications and requirements that lenders typically look for. These factors play a crucial role in determining whether a business is eligible for this type of financing.

Qualifications Needed

- A strong personal credit score: Lenders often require a good personal credit score, typically above 680, to demonstrate your creditworthiness.

- Business revenue: New businesses may need to show a steady stream of revenue to prove they can repay the credit line.

- Business age: While new businesses can still qualify, some lenders prefer to see that the business has been operational for a certain period of time, usually at least six months to a year.

Requirements for Approval

- Business plan: Lenders may request a detailed business plan outlining how the credit will be used and how it will benefit the business.

- Financial statements: Providing financial statements such as income statements, balance sheets, and cash flow projections can help lenders assess the financial health of the business.

- Collateral: Unlike secured credit options, unsecured business lines of credit do not require collateral. However, lenders may still look at the overall financial stability of the business.

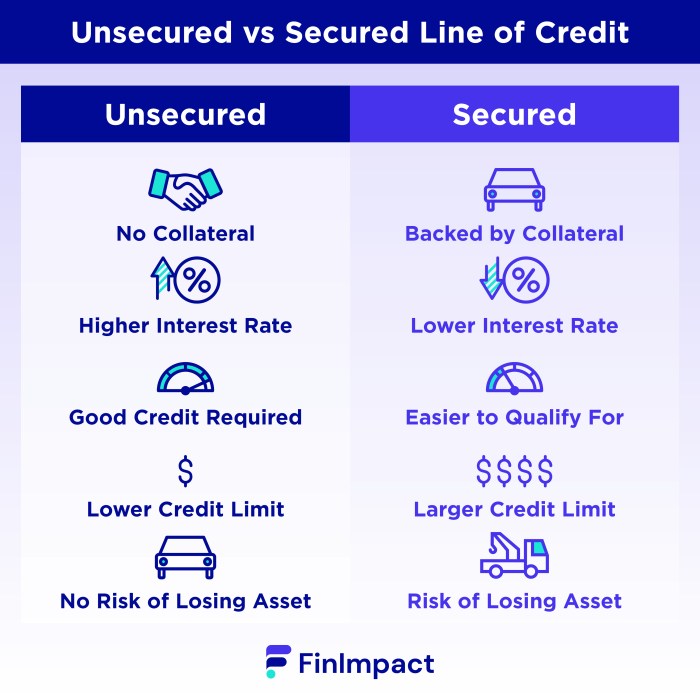

Comparison with Secured Credit

When comparing qualifications for unsecured credit with secured credit options, the main difference lies in the collateral requirement. Secured credit lines are backed by assets such as property or equipment, which reduces the lender's risk. On the other hand, unsecured credit relies more on the borrower's creditworthiness and business performance.

Pros and Cons of Unsecured Business Lines of Credit

When considering unsecured business lines of credit for a new business, it is essential to weigh the pros and cons to make an informed decision that aligns with your financial goals and risk tolerance.

Advantages of Opting for Unsecured Credit

- Flexibility: Unsecured business lines of credit offer flexibility in terms of usage, allowing businesses to access funds for various needs such as inventory purchases, equipment upgrades, or operational expenses.

- No Collateral Required: Unlike secured loans, unsecured credit does not require collateral, which can be advantageous for new businesses without substantial assets to pledge.

- Quick Access to Funds: Unsecured credit typically has a faster approval process, enabling businesses to access funds quickly when needed, which can be crucial for seizing opportunities or addressing emergencies.

- Build Business Credit: Successfully managing unsecured credit can help new businesses establish a positive credit history and improve their credit score, making it easier to qualify for larger loans in the future.

Potential Disadvantages or Risks

- Higher Interest Rates: Unsecured credit often comes with higher interest rates compared to secured loans, which can increase the overall cost of borrowing for the business.

- Limited Loan Amounts: Due to the lack of collateral, the loan amounts available through unsecured credit may be lower than what could be obtained with secured financing, limiting the business's borrowing capacity.

- Risk of Default: Without collateral to secure the debt, there is a higher risk of default for the lender, which could lead to negative consequences for the business, such as damage to credit score or legal action.

- Stricter Eligibility Criteria: Lenders may have stricter eligibility requirements for unsecured credit, such as higher credit score thresholds or revenue benchmarks, making it challenging for some new businesses to qualify.

Real-Life Scenarios

- Success Story:A new boutique clothing store secured an unsecured business line of credit to fund its initial inventory purchase. With quick access to funds, the store was able to stock up on trendy merchandise and attract customers, leading to a successful launch and steady growth.

- Challenges Faced:A tech startup opted for unsecured credit to finance its product development but struggled to make timely repayments due to cash flow constraints. This led to mounting interest payments and strained relationships with suppliers, highlighting the risks of unsecured borrowing for businesses with uncertain revenue streams.

Application Process and Tips

When it comes to applying for an unsecured business line of credit, there are several steps that new businesses need to follow to increase their chances of approval. Additionally, there are tips and strategies that can be implemented to negotiate favorable terms and conditions for the credit agreement.

Typical Application Process for Unsecured Business Lines of Credit

- Start by researching different lenders that offer unsecured business lines of credit and compare their terms and interest rates.

- Prepare all necessary financial documents, such as business tax returns, bank statements, and financial projections.

- Fill out the application form provided by the lender, providing accurate and detailed information about your business.

- Wait for the lender to review your application and conduct a credit check to assess your creditworthiness.

- If approved, review the terms and conditions of the credit agreement carefully before accepting the offer.

Tips for New Businesses to Improve Approval Chances

- Build a strong business credit profile by making timely payments on existing debts and maintaining a positive credit history.

- Showcase a solid business plan that Artikels your business goals, revenue projections, and how the credit will be used to grow the business.

- Establish a relationship with the lender by opening a business checking account or applying for a business credit card before seeking a line of credit.

- Provide collateral or a personal guarantee to secure the credit line, if possible, to reduce the lender's risk.

Strategies for Negotiating Favorable Terms and Conditions

- Highlight your business's strong financial performance and growth potential to demonstrate your ability to repay the credit line.

- Negotiate for a lower interest rate or higher credit limit based on your business's financial stability and creditworthiness.

- Request flexibility in repayment terms, such as interest-only payments during the initial period or a longer repayment term to reduce monthly payments.

- Seek a line of credit with no annual fees or prepayment penalties to avoid additional costs and restrictions.

Final Wrap-Up

In conclusion, Unsecured Business Lines of Credit offer a flexible and accessible funding solution for new businesses, paving the way for growth and success. As you embark on your entrepreneurial journey, consider the possibilities that unsecured credit can bring to your venture.

Essential Questionnaire

What are the typical qualifications for obtaining an unsecured business line of credit?

The qualifications often include a good credit score, stable revenue stream, and business plan outlining how the funds will be utilized.

Are unsecured credit lines riskier for new businesses compared to secured options?

While unsecured credit offers flexibility, it can come with higher interest rates and lower credit limits, posing financial risks if not managed effectively.

How can new businesses enhance their chances of approval for unsecured credit?

New businesses can strengthen their applications by demonstrating a solid business strategy, maintaining a healthy credit profile, and showcasing potential for growth.