Exploring the optimal timing for applying for a business line of credit can be crucial for companies looking to manage their finances effectively. Understanding the key factors and considerations before diving into this financial tool is essential. Let's delve into the insights and information surrounding the ideal timing for businesses to apply for a business line of credit.

As we navigate through the details and examples provided, you will gain a comprehensive understanding of when and why applying for a business line of credit can be a strategic move for your company.

Importance of Business Line of Credit

Having a business line of credit can be crucial for the financial health and flexibility of a company. It offers several benefits that can help businesses navigate cash flow challenges and seize growth opportunities.

Benefits of Business Line of Credit

- Flexibility: Unlike a traditional business loan where you receive a lump sum, a line of credit allows you to borrow funds as needed up to a predetermined limit. This flexibility can help manage fluctuations in cash flow or unexpected expenses.

- Lower Interest Costs: With a line of credit, you only pay interest on the amount you borrow, not the entire credit limit. This can result in lower overall interest costs compared to a term loan.

- Quick Access to Funds: Business lines of credit typically have a faster approval process than traditional loans, allowing you to access funds quickly when needed.

Differences from Traditional Business Loan

- Revolving Structure: A business line of credit is revolving, meaning you can borrow, repay, and borrow again up to the credit limit. In contrast, a traditional loan is a one-time lump sum with fixed monthly payments.

- Interest Calculation: Interest on a line of credit is only charged on the outstanding balance, while traditional loans accrue interest on the entire loan amount from the start.

- Usage Flexibility: Business lines of credit offer more flexibility in how funds are used, whether for working capital, inventory purchases, or other business needs.

Examples of Situations

- Seasonal Businesses: A line of credit can help seasonal businesses manage cash flow during slow months and ramp up operations when demand is high.

- Emergencies: Having a line of credit can provide a safety net for unexpected expenses or emergencies, ensuring the business can continue operating smoothly.

- Growth Opportunities: When a business encounters a growth opportunity, a line of credit can provide the necessary funds to invest in expansion without depleting cash reserves.

Factors to Consider Before Applying

Before applying for a business line of credit, there are several key factors that businesses should carefully consider to increase their chances of approval and ensure they are making a sound financial decision. One of the most important factors to evaluate is the business's credit score and financial history.

Credit Score and Financial History Impact

Having a strong credit score and a positive financial history is crucial when applying for a business line of credit. Lenders use this information to assess the risk of lending to a business and determine the terms of the credit line.

A good credit score demonstrates financial responsibility and can help secure better interest rates and higher credit limits. On the other hand, a poor credit score or a history of financial mismanagement can result in higher interest rates or even a denial of the credit application.

Clear Purpose and Plan for Use

Businesses should have a clear purpose and plan for the use of the credit line before applying. Whether it is for covering operational expenses, investing in growth opportunities, or managing cash flow during seasonal fluctuations, having a well-defined plan for how the credit will be utilized can increase the likelihood of approval.

Lenders want to see that the business has a strategic reason for seeking a line of credit and that the funds will be used responsibly to support the company's growth and success.

Ideal Timing for Applying

Deciding when to apply for a business line of credit is crucial for the financial health of your company. It is essential to recognize the right timing based on various financial indicators.

Financial Indicators for Applying

- Stable Cash Flow: A consistent and healthy cash flow is a good sign that your business can handle the repayments of a line of credit.

- Growth Opportunities: If your company is experiencing growth and expansion, a line of credit can provide the necessary funds to support these opportunities.

- Seasonal Sales: For businesses with fluctuating sales throughout the year, a line of credit can help bridge the gap during slower periods.

Advantages of Applying

- Emergency Funds: Having a line of credit in place can provide quick access to funds in case of unexpected expenses or cash flow shortages.

- Business Expansion: Applying for a line of credit can help finance new projects, hire additional staff, or invest in marketing initiatives to grow your business.

- Covering Operating Expenses: In times of financial strain, a line of credit can help cover day-to-day operating costs until revenue picks up.

Application Process and Requirements

When applying for a business line of credit, there is a specific process that businesses need to follow. Additionally, certain documentation and information are required, and eligibility criteria must be met in order to qualify. Let's delve into the details.

Typical Application Process

- Research and compare different lenders offering business lines of credit.

- Submit an application with the necessary documentation and information.

- Wait for the lender to review your application and make a decision.

- If approved, review and sign the terms and conditions of the line of credit.

Documentation and Information Required

- Business financial statements, including income statements and balance sheets.

- Personal and business tax returns for the past few years.

- Business plan outlining how the line of credit will be used.

- Proof of business ownership and legal structure documents.

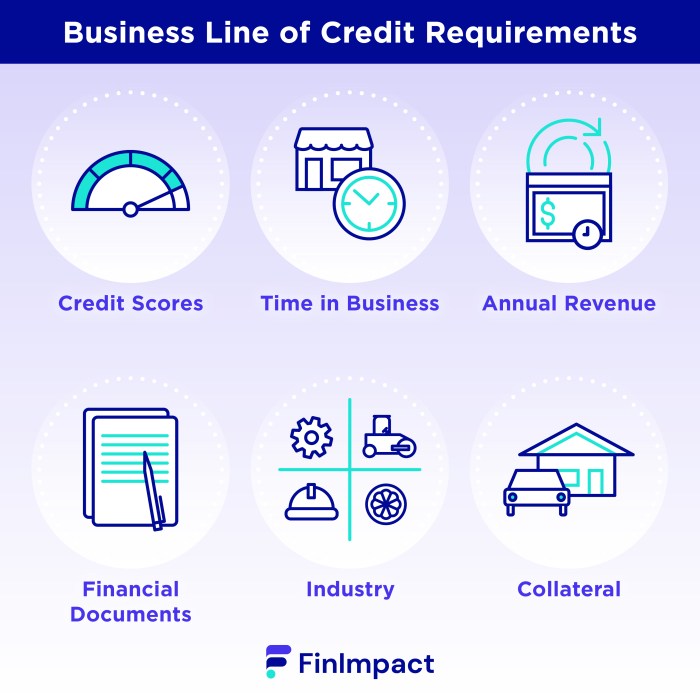

Common Eligibility Criteria

- Minimum annual revenue and time in business requirements.

- Good personal and business credit scores.

- Demonstrated ability to repay the line of credit.

- Positive cash flow and profitability.

Closure

In conclusion, knowing when to apply for a business line of credit can make a significant difference in how your company navigates financial challenges and opportunities. By considering the factors discussed and understanding the process involved, you can make informed decisions that benefit your business in the long run.

Common Queries

When is the right time to apply for a business line of credit?

The right time to apply for a business line of credit is when your company needs flexible access to funds for short-term expenses or unexpected opportunities.

How does a business line of credit differ from a traditional business loan?

A business line of credit provides ongoing access to a set credit limit that you can borrow from as needed, while a traditional business loan provides a lump sum of money upfront.

What factors should businesses consider before applying for a business line of credit?

Businesses should consider their financial stability, cash flow needs, and the purpose for which they will use the credit line before applying.