Kicking off with How to Qualify for a Flexible Business Line of Credit, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

The concept of a flexible business line of credit differs from traditional loans, offering various benefits to businesses. Understanding the qualification requirements and necessary documentation is crucial in securing this type of credit.

Understanding Flexible Business Lines of Credit

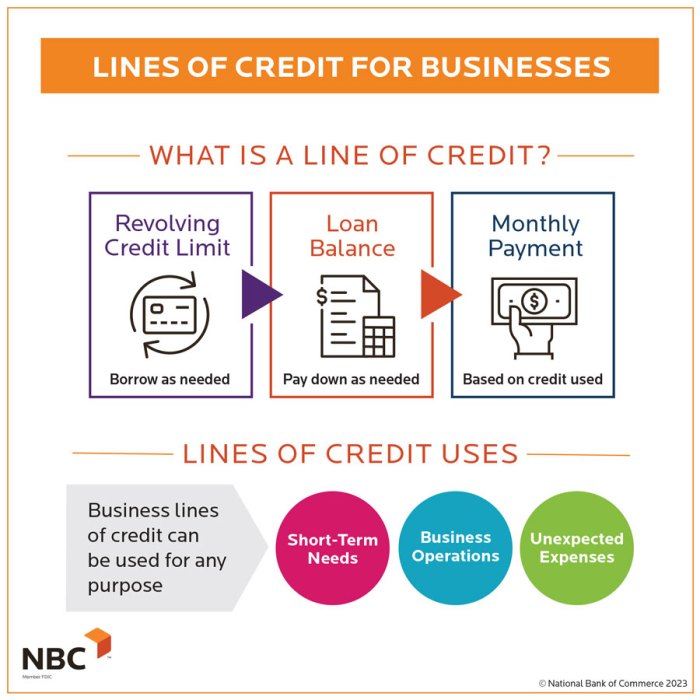

A flexible business line of credit is a financial product that allows businesses to access a predetermined amount of funds that they can draw from as needed. Unlike traditional loans, where the borrower receives a lump sum upfront and repays it over a fixed period, a business line of credit provides more flexibility and control over when and how much to borrow.

Having a flexible business line of credit offers several benefits to businesses. One key advantage is the ability to access funds quickly and easily, providing a financial safety net for unexpected expenses or cash flow gaps. Businesses can also use the line of credit to take advantage of growth opportunities or cover seasonal fluctuations in revenue.

Typical Features and Terms of Flexible Business Lines of Credit

- Revolving Credit: A business line of credit is typically revolving, meaning that as you repay the borrowed amount, the funds become available for you to borrow again.

- Interest Rates: Interest is charged only on the amount you borrow, not the entire credit line. Rates can be variable or fixed, depending on the lender.

- Credit Limit: Lenders set a maximum credit limit based on the creditworthiness of the business. This limit can be adjusted over time based on the performance of the business.

- Repayment Terms: Businesses have the flexibility to repay the borrowed amount over a specified period, usually with minimum monthly payments.

- Accessibility: Business lines of credit can be accessed through checks, online transfers, or credit cards linked to the account.

Qualification Requirements for a Flexible Business Line of Credit

When it comes to qualifying for a flexible business line of credit, there are several key eligibility criteria that lenders typically look at. These criteria can vary depending on the lender, but there are some common requirements that most businesses need to meet in order to be considered for this type of credit.

Credit Score

One of the most important factors that lenders consider when evaluating a business for a flexible line of credit is the business owner's credit score. A good credit score demonstrates a history of responsible financial management and can increase the chances of approval for a line of credit.

Lenders often prefer to work with businesses that have a credit score of 600 or higher.

Business Revenue and Financial History

In addition to the credit score, lenders also assess the business's revenue and financial history. They want to see that the business has a steady income and a positive financial track record. This helps lenders gauge the business's ability to repay the credit line in a timely manner.

A strong financial history can increase the likelihood of approval for a flexible line of credit.

Other Factors

Other factors that may play a role in qualifying for a flexible business line of credit include the length of time the business has been operating, the industry it operates in, and any existing debts or liabilities. Lenders want to ensure that the business is stable, reliable, and has the capacity to manage additional credit responsibly.

Documentation and Preparation

When applying for a flexible business line of credit, it is essential to have all the necessary documentation in order and be well-prepared. This can significantly impact your chances of qualifying for the credit you need

Checklist of Required Documents

- Business financial statements (profit and loss statement, balance sheet)

- Personal and business tax returns

- Business licenses and registrations

- Bank statements

- Proof of business ownership

- Business plan

Well-Prepared Business Plan

Having a well-prepared business plan can greatly increase your chances of qualifying for a flexible business line of credit. A comprehensive business plan demonstrates to lenders that you have a clear vision for your business and a well-thought-out strategy for growth and success.

Importance of Organized Financial Records

Keeping your financial records organized is crucial when applying for a flexible business line of credit. Lenders will want to review your financial history to assess your creditworthiness and ability to repay the credit. Organized financial records make it easier for lenders to evaluate your financial health and make a decision on your credit application.

Tips for Improving Your Qualification Odds

When it comes to qualifying for a flexible business line of credit, there are several strategies you can implement to improve your odds of approval. By focusing on boosting your credit score, demonstrating strong cash flow and revenue history, and building a good relationship with your business bank, you can enhance your chances of securing the funding you need.

Boosting Your Credit Score

If you're looking to apply for a flexible business line of credit, it's essential to work on improving your credit score beforehand. A higher credit score not only increases your chances of approval but also helps you secure better terms and rates.

To boost your credit score, make sure to pay your bills on time, keep your credit utilization low, and monitor your credit report for any errors that need to be corrected.

Demonstrating Strong Cash Flow and Revenue History

Another crucial factor that can positively impact your application for a flexible business line of credit is demonstrating a strong cash flow and revenue history. Lenders want to see that your business is generating consistent income and managing its finances effectively.

By providing detailed financial statements, profit and loss reports, and cash flow projections, you can showcase your business's financial health and increase your chances of approval.

Building a Good Relationship with Your Business Bank

Building a good relationship with your business bank can also enhance your chances of qualifying for a flexible line of credit. By maintaining regular communication, keeping your accounts in good standing, and seeking advice from your bank's financial experts, you can show lenders that you are a reliable and trustworthy borrower.

This can make a positive impression on lenders and increase your likelihood of approval.

Final Wrap-Up

In conclusion, qualifying for a flexible business line of credit requires careful consideration of eligibility criteria, preparation of essential documents, and strategic steps to improve qualification odds. By following these guidelines, businesses can enhance their chances of securing the credit they need.

Helpful Answers

What factors play a role in qualifying for a flexible business line of credit?

Factors such as business revenue, financial history, and credit score are essential in determining eligibility for a flexible business line of credit.

How can I improve my qualification odds for a flexible business line of credit?

To enhance your chances, focus on boosting your credit score, demonstrating strong cash flow and revenue history, and building a good relationship with your business bank.

What documents are typically required when applying for a flexible business line of credit?

Commonly needed documents include financial statements, tax returns, business plans, and proof of business ownership.